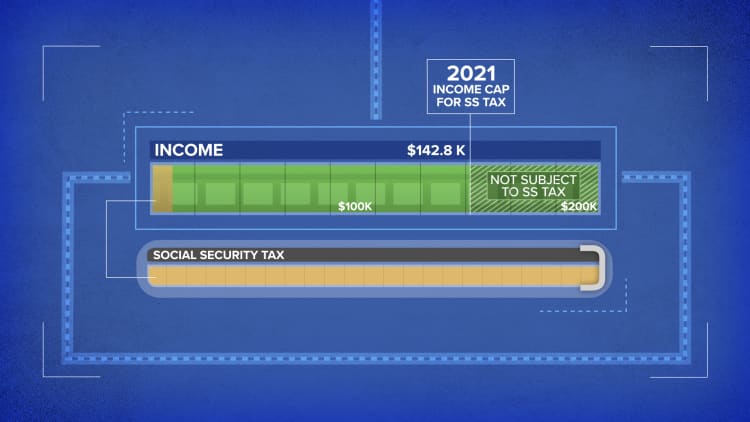

Wage Cap Allows Millionaires to Stop Contributing to Social Security on February 19, 2020 - Center for Economic and Policy Research

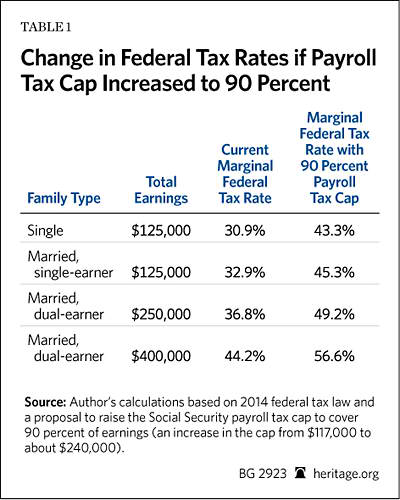

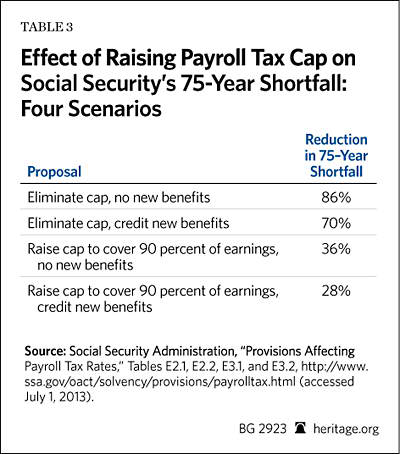

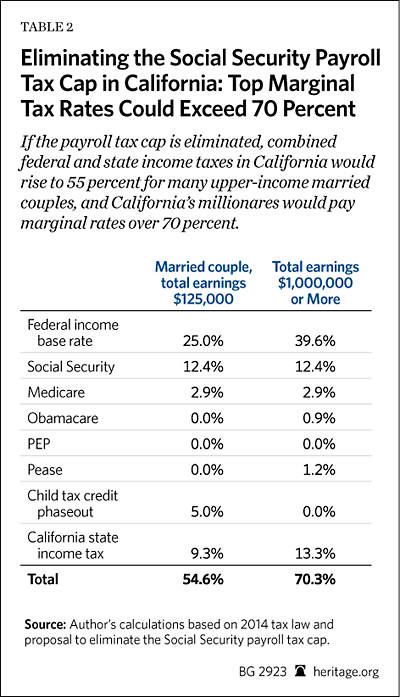

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

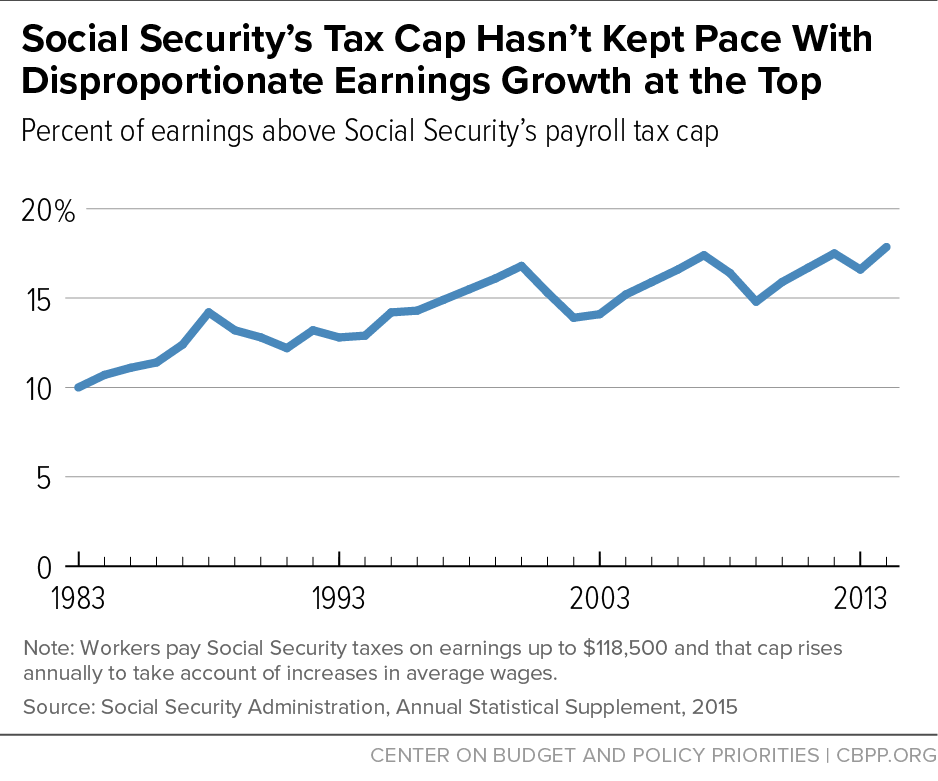

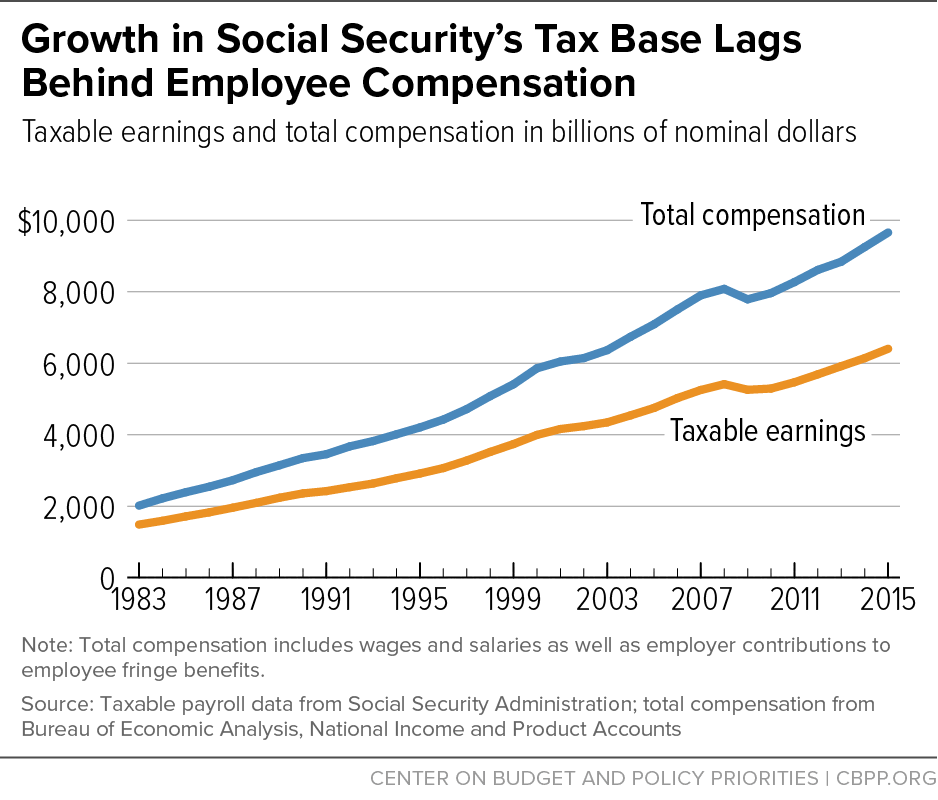

Removing the Social Security earnings cap virtually eliminates funding gap | Economic Policy Institute

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Scrap the Cap: Strengthening Social Security for Future Generations – Social Security Works – Washington

:max_bytes(150000):strip_icc()/GettyImages-1168040761-5ae0caa8adf64faa960c2e4964ca1333.jpg)